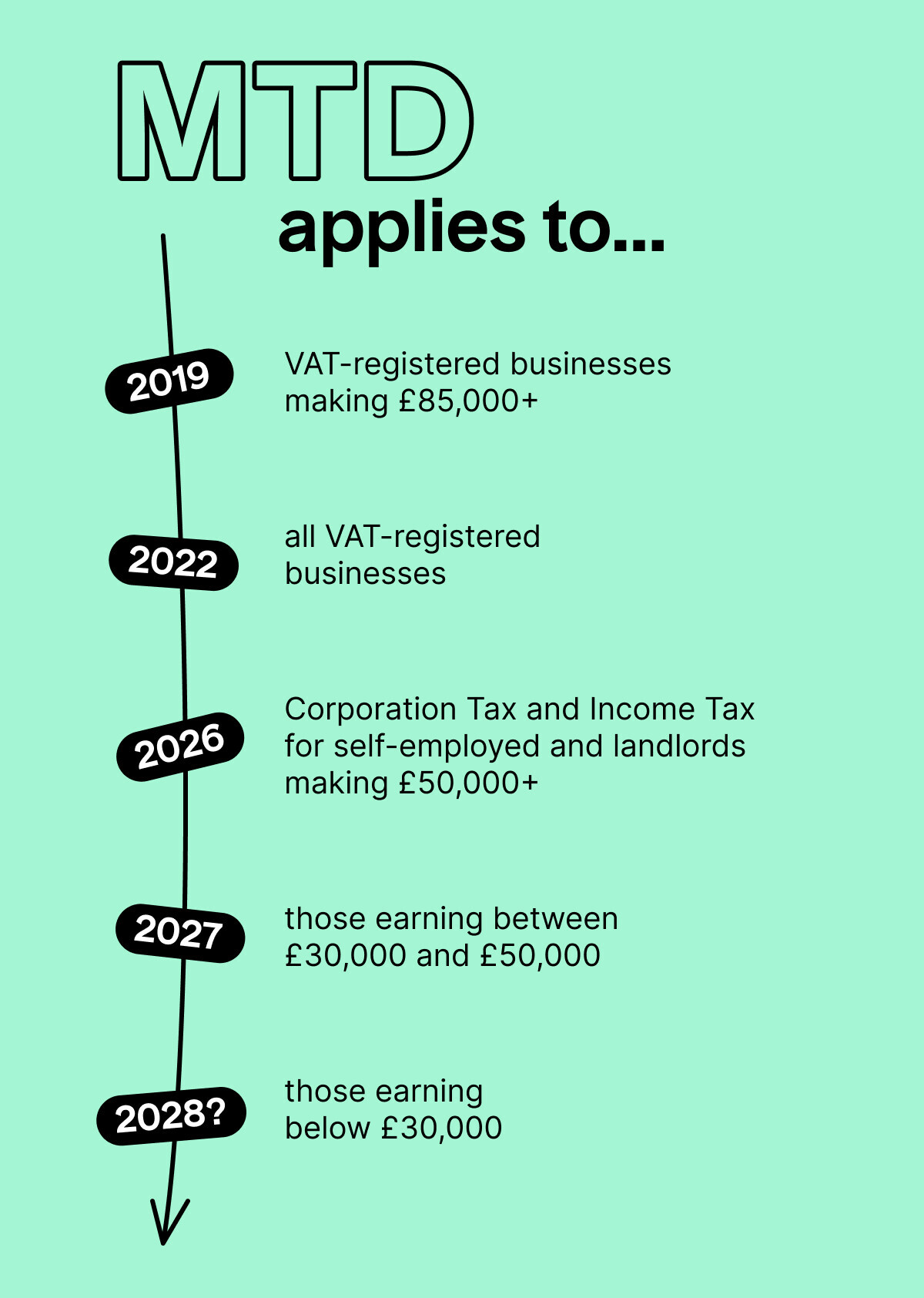

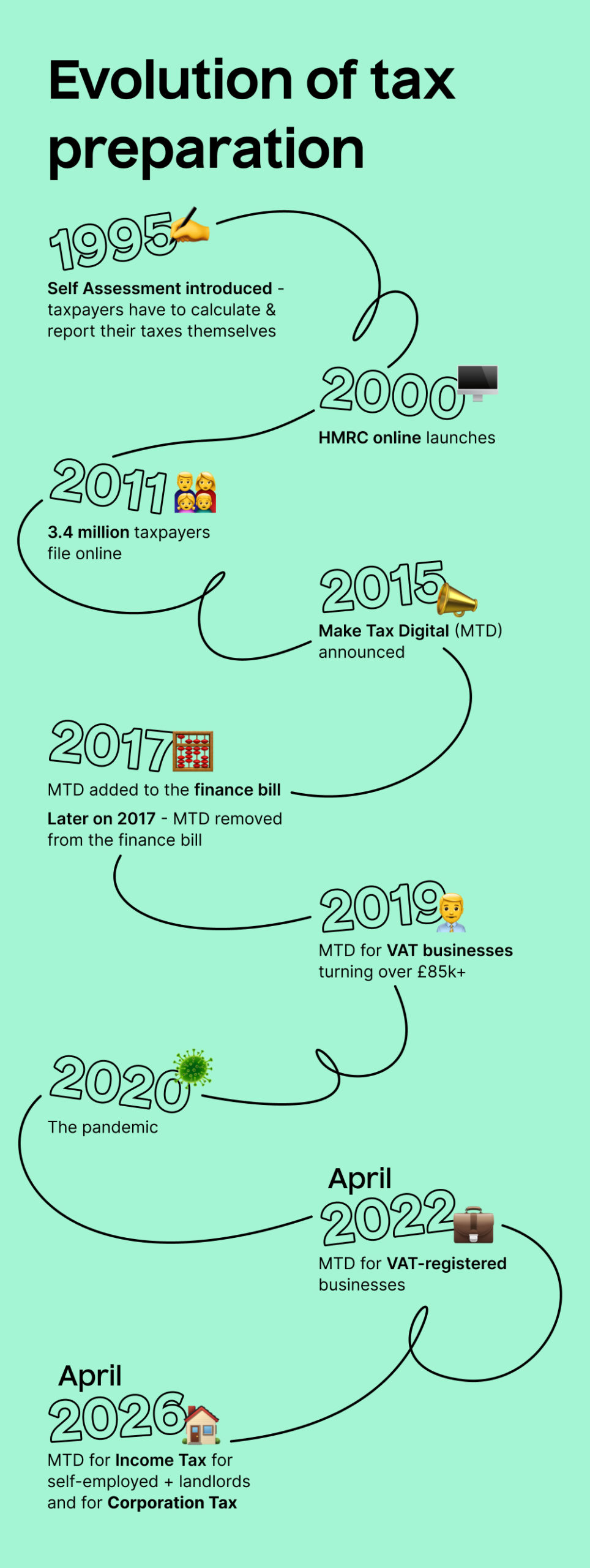

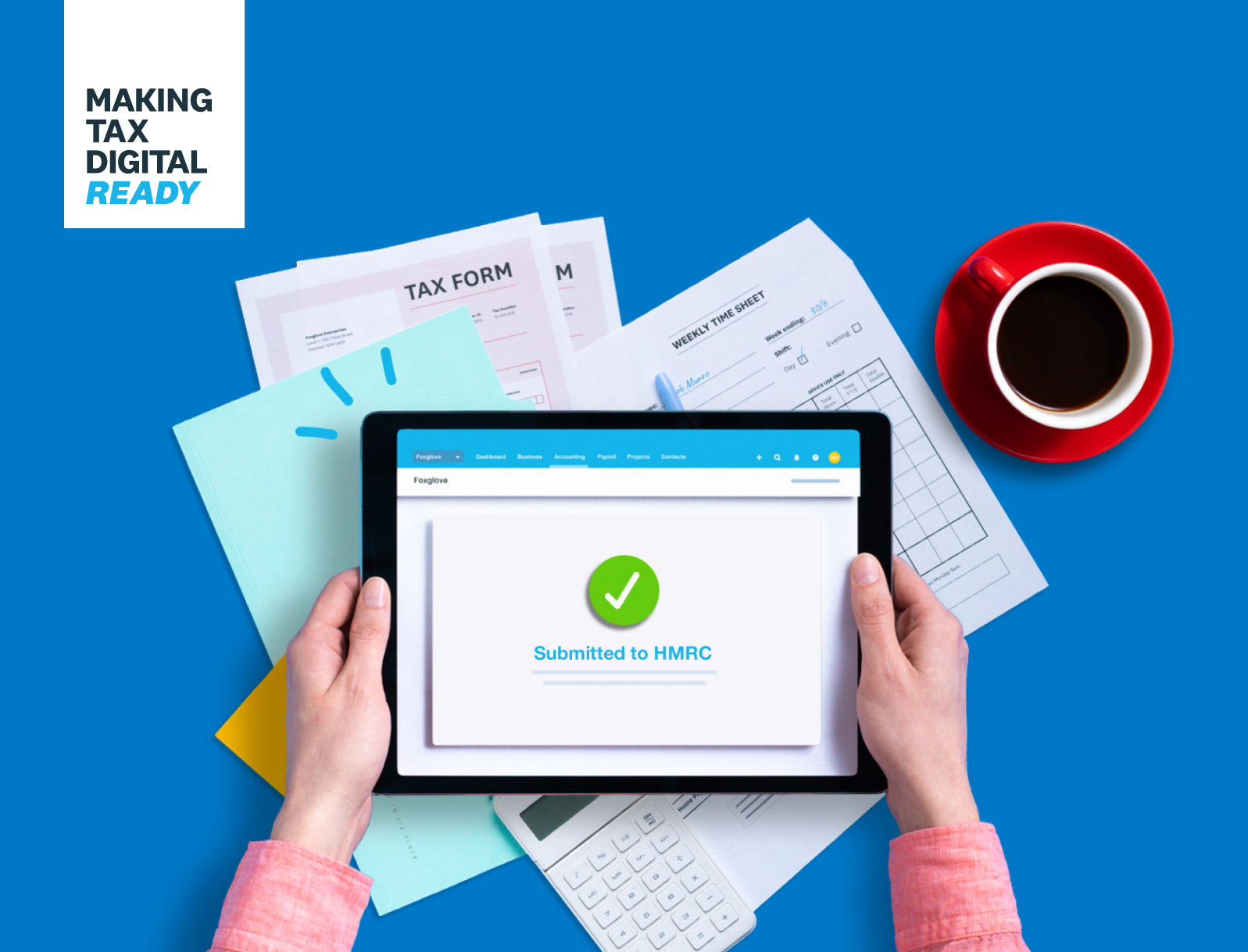

Cadaea on Twitter: "UK Creators!! Are you self-employed, not VAT registered, & not aware of how Making Tax Digital (MTD) might affect you in the next few years? Well, let's discuss 👇" /

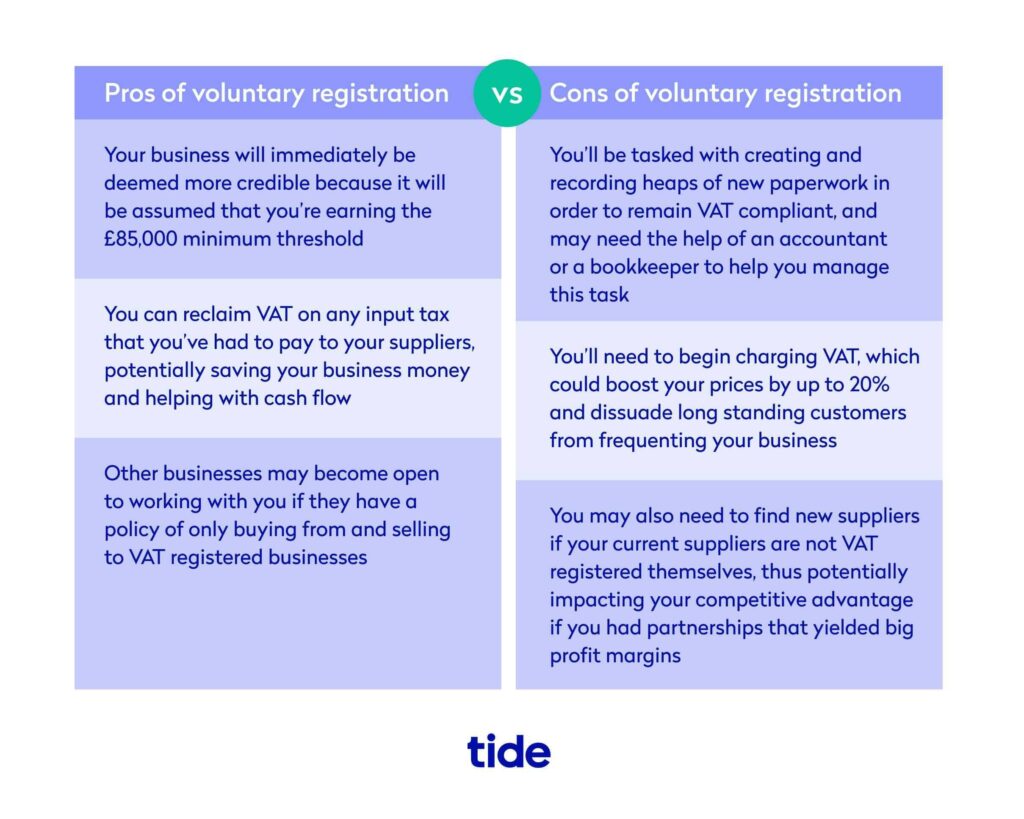

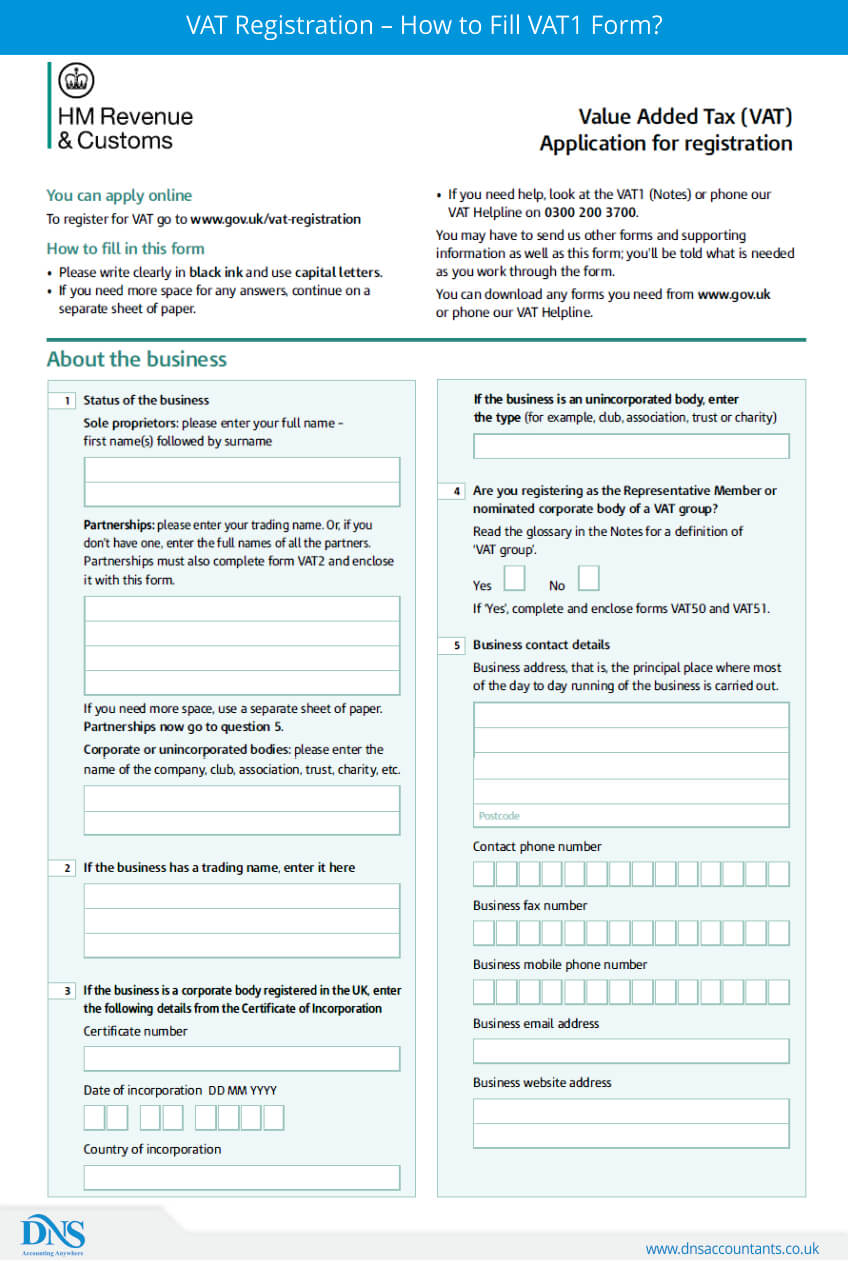

Are you in low paid self-employment and considering becoming VAT registered? | Low Incomes Tax Reform Group

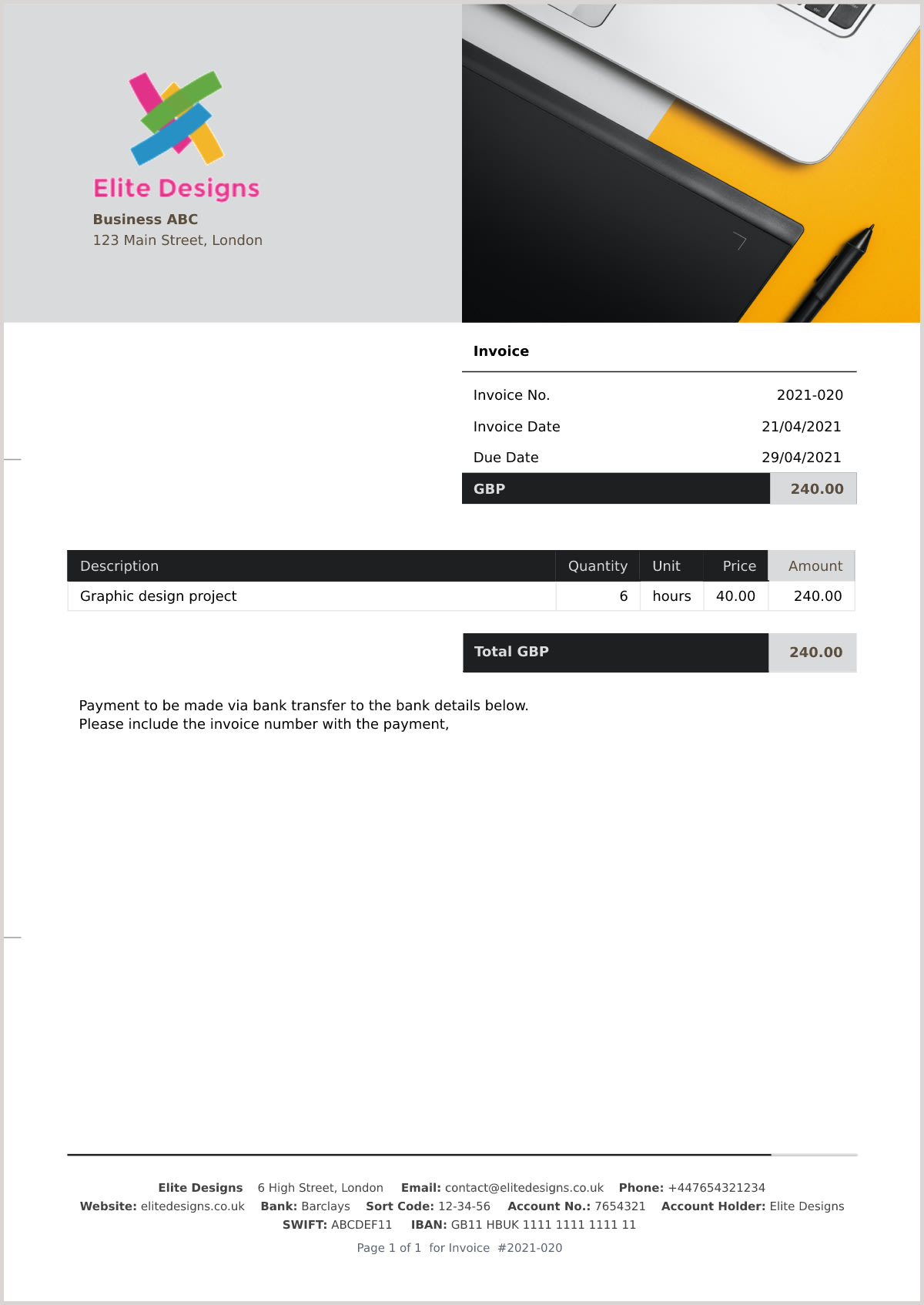

![Income Tax for Self-Employed Professionals [Infographic] Income Tax for Self-Employed Professionals [Infographic]](https://cloudcfo.ph/wp-content/uploads/2019/09/tax-options-1024x1024.png)